real estate japan shiftjapan

Depreciable assets are subject to the fixed-assets tax.

Real estate sales agreements for the purchase of land and buildings or contract agreements for the commissioning of construction work, etc. need to be affixed with a stamp and postmarked.

| Type of assets | Examples |

| Buildings and structures | Electricity receiving/transmission equipment, paved roads, gardens, external structure works such as gates, walls, fences and greening facilities, billboards including advertising towers, etc. |

| Machinery and equipment |

Various kinds of production facilities, machinery, and equipment, mechanical parking facilities(including turntables, etc.) |

| Boats and ships | Boats, fishing vessels, pleasure boats, etc. |

| Aircraft | Airplanes, helicopters, gliders, etc. |

| Automobiles and other vehicles |

Large-sized special motor vehicles, platform trucks, freight vehicles, passenger cars, etc. |

| Tools, appliances, and parts |

PCs, display cases, signboards, medical equipment, measuring equipment, molds, barber and hairdressing equipment, screens, airconditioners, furniture for drawing rooms, register, automat, etc. |

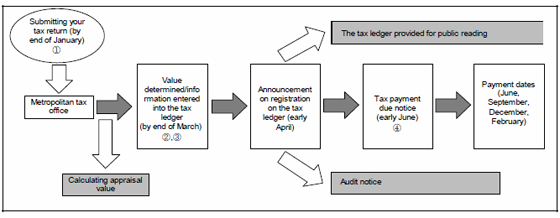

(1)Submitting your tax return

Taxpayers in possession of depreciable assets as of January 1 in any given year must report said depreciable assets to the metropolitan taxation office in which the assets are located (for the 23 wards of Tokyo) by January 31 of that year.

To prepare a tax return on depreciable assets, a corporation should refer to the fixed assets ledger and the corporate tax return form (e.g., Appendix 16 2), and an individual should refer to the data of depreciation on the income tax return, the ledger of fixed assets, etc.

(2)Value determined/information entered in the tax ledger

The value of depreciable assets is determined based on the information contained in the taxpayer’s tax return and on auditing results. The value is entered in the depreciable assets tax ledger by March 31.

(3)Tax base

Taxes are assessed based on the depreciable asset value (appraisal value or book value) as of the base date

for assessment (January 1) as indicated in the depreciable assets taxation ledger.

(4)Tax notice issued

The tax amount is based on the equation below and a tax notice issued accordingly.

The tax amount is calculated by multiplying the tax base amount by the tax rate (1.4/100).

If the sum of the tax base amounts calculated at assessment is less than ¥1,500,000 (tax exemption limit),

no fixed asset tax is imposed.

Building Ownership

The tax also applies to such structures as equipment attached to buildings including equipment for receiving transmitted electricity, storage battery equipment, and constructed items such as automated parking lot equipment, turn-tables, constructed facades, advertising towers, etc. as depreciable fixed assets.

Tenants Renting Offices or Other Space

Taxation is applicable to depreciable fixed assets such as interior fixtures and building equipment installed by a tenant.

Issued September2008(H20)

Edited and Issued by:

General Affairs Section, General Affairs Division

Tokyo Metropolitan Government Bureau of Taxation