real estate japan shiftjapan

[Taxpayers]

Those who were registered in the fixed assets tax register as of January 1 as owners of land and houses.

[Tax Payment]

[Due Date and Tax Payment Procedures]

Tax payment

must be made four times a year(June,September,December,and February),in

accordance with the Notice of Tax Due statement sent to you in the

first tax due month.(For tax payment due dates in cities,towns,or

village municipalities,see page 79).The city planning tax is levied

in conjunction with the fixed assets tax on land,houses and buildings.

The Notice of Tax Due statement incorporates both the city planning

tax due and the fixed assets tax due.

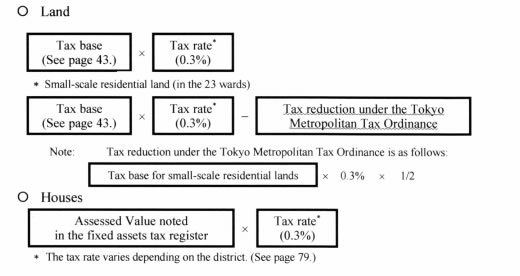

Computation of the City Planning Tax

Land and houses/buildings on which the city planning tax is levied are also subject to the fixed assets tax.Accordiingly,the tax due is computed on the basis of the assessed value noted in the fixed assets tax register.For the 23 wards,the tax rate is 0.3%.See page 79 for municipality tax rates. With regard to land,there is in place a tax burden adjustment system based on the burden level.Under this system,tax reduction or deferment(as in the case of fixed assets tax)is applied to taxpayers whose burden level is at or above the prescribed level. Note that the city planning tax due(in the 23 wards) on small-scale residential land(a portion of the residential land up to 200 m2 per house)is reduced bby one-half for 2008(H20).

Reducing the Tax Burden on Commercial Land(lowering upper limits in the 23 wards)

Where the fixed asset and city planning tax burden exceeds 65%

on commercial land located in the 23 wards for 2008(H20),the burden

is reduced to a maximum of 65% from 70%.

Residentaial land

used for purposes other than residential housing.including shop

and factory sites,parking lots, and more.

Issued September2008(H20)

Edited

and Issued by:

General Affairs Section, General Affairs Division

Tokyo

Metropolitan Government Bureau of Taxation